The partnership space is set to flourish this year. But there’s a number of questions that need answering before we surge on into 2023.

How can the channel better accommodate creators? What technology should we focus our attention on? Where is there untapped potential?

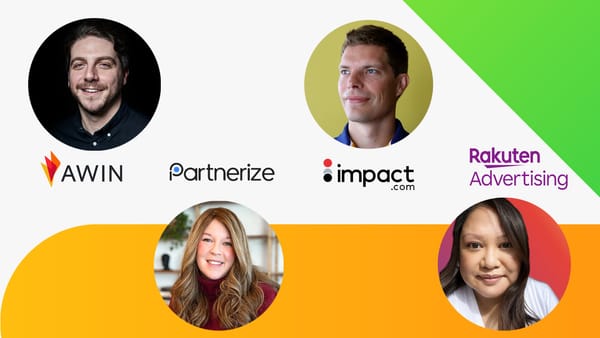

Matt Gilbert, CEO of Partnerize, digs into all the above, plus more, in the following conversation, to help you prepare for the year ahead and ensure you’re optimising your efforts in the partnership channel this year.

Last year, you said you expected 2022 to be a year of ‘accelerated innovation’. How did that prediction turn out and what shaped the advances you saw? Do you expect that acceleration to slow down in 2023 or do you see even greater speed in the changes to the marketplace?

I think that prediction was more accurate than not. Innovation does not always need to be defined as radical change or disruption, often innovation is incremental, and I think 2022 was a year where the SaaS platforms were largely and responsibly focused on incremental improvements and enhancements and integrating capabilities of acquisitions more seamlessly into workflows and user interfaces. At Partnerize, we released over 40 new substantive improvements to capabilities on our platform including a category leading commission rule builder that enables automated deployment of commission rule updates, a capability even more critical given the volatile macroeconomic environment; and comparison reporting improvements to increase not only visibility but actionability of program level data. Most recent is the launch of our PZ tag, which enables the turnkey rollout of third-party capabilities to live programmes, will enable partners to generate and update links, and ensures programs will retain uninterrupted partner channel tracking including dynamic real time tracking changes to protect from the certainty of continuing go forward shifts in tracking protocols.

For the legacy networks, it seems that overall, 2022 was more of a “catch up” year, where they tried to make progress toward closing the gap with the innovation led by the SaaS platforms, working to overcome long accumulated technical debt, and integrating third-party data sources to append partner data and influencer platform APIs.

I also think every company had to deal with the ramifications of the “great resignation” during the first half of the year, which had a measurable effect on release cycles and overall productivity.

2023 will be a year that is difficult to predict with broad brush strokes. Many companies, including in our category, will struggle to manage their expense profile and R&D investment may decline as a result. This may especially be the case at earlier stage business from which disruptive innovation often emanates. For those businesses with healthy balance sheets, and the related ability to accelerate, 2023 represents a compelling opportunity to take market share. Businesses in a position to capitalise on that advantage will put rigour and resources against realising it. Every company will be compelled to ruthlessly prioritise their roadmaps and focus their execution on those efforts deemed to present the highest value opportunities for their clients, both brand and partner.

Not to be overlooked is the increased probability of consolidation taking place in the category and when it does, what that will mean for innovation. I do expect consolidation this year and the natural follow on to that will be product and engineering resources focused on integration and platform consolidation for a period before re-emerging to focus heavily on disruptive innovation.

In which areas of the partnership space do you see untapped potential for innovation during 2023?