In the rapid world of affiliate marketing, maximising revenue is key to maintaining a competitive edge. A few weeks ago, we discussed new instant payout systems as a means of increasing affiliate marketing revenue and posed the question of whether such systems will become the new norm for the affiliate and partner marketing industry.

After conducting months of research, the Admitad partner network team has found a direct link between faster affiliate payments and increased revenues. Here are a few key findings.

Fast payment systems are like launching your own in-house banking service

In introducing Instant Payout, an advanced payment system, a few months ago, Admitad wanted to help affiliates receive their earnings from affiliate campaigns even quicker.

Affiliates who met the eligibility criteria were granted access to the tool, which enabled them to request instant commission payouts right after the registration of actions. Funds would then be instantly deposited into their chosen payment account, eliminating the standard waiting period before funds were made available, and offering immediate access to hard-earned rewards. Using trained AI algorithms, Admitad Instant Payout Pro predicts if an action will be approved by an advertiser, disbursing rewards to publishers ahead of time. In effect, the network serves as an in-house bank for partners by securing any eligible fast transaction.

Feedback shows partners couldn’t start using Instant Payout fast enough

After its release, an immediate high demand for the service has been noticed. 25% of partners eligible to use the tool began testing it, and half of them made at least one repeat order.

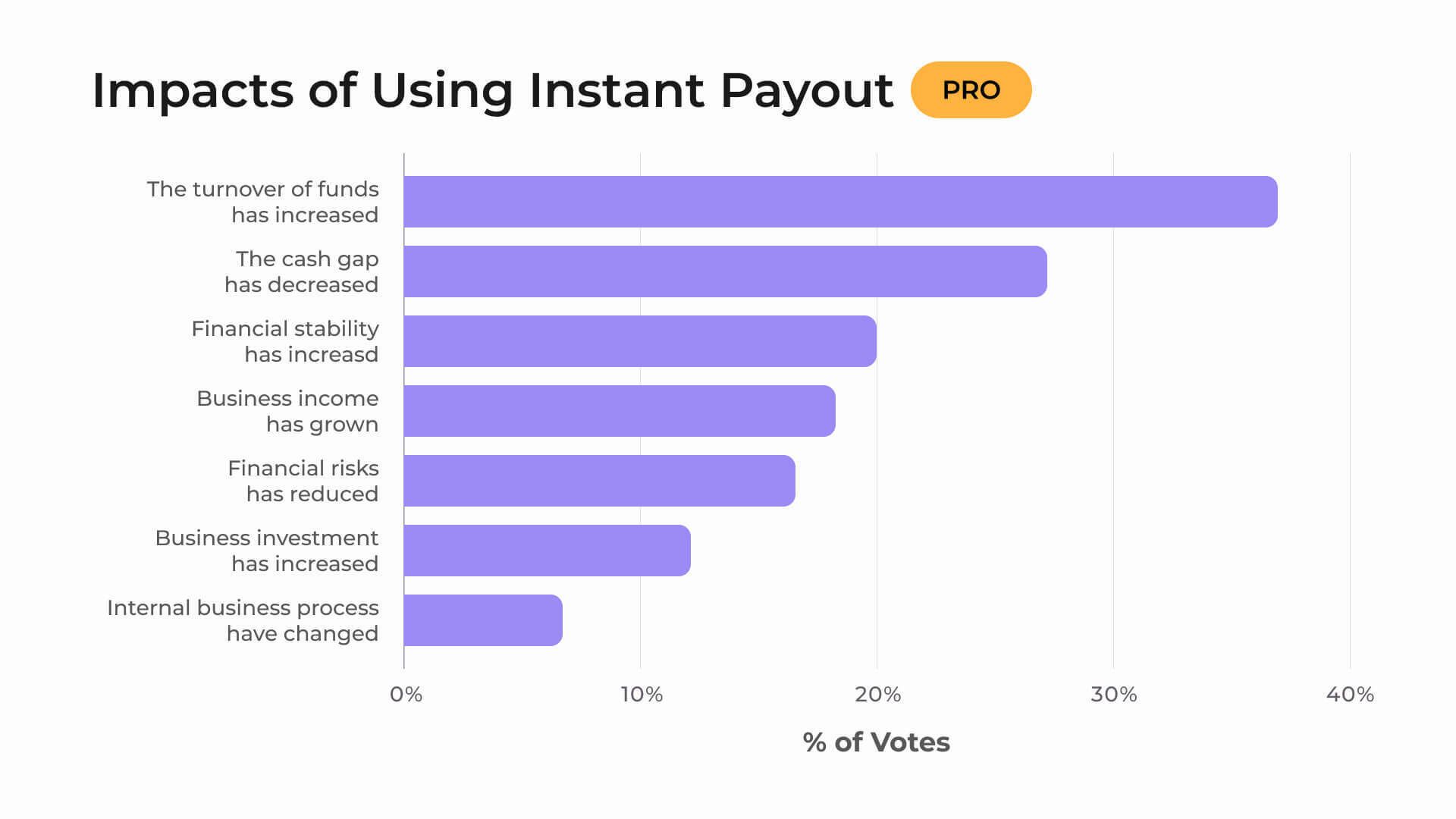

Asking 100 Instant Payout users how the feature had influenced their financial situations, here are the numbers:

- 36% answered that their turnover of funds had increased. Faster access to funds allowed affiliates to quickly reinvest them, launching new campaigns and seizing new opportunities, ultimately boosting revenue.

- 27% noticed that their cash gap had decreased. With Instant Payout, the time between expenses and revenue is minimised, ensuring a smoother cash flow for affiliates.

- For 20%, financial stability had increased. Immediate access to earnings fostered stability, as affiliates could manage cash flow and meet financial obligations without delay.

- Also, 17% saw that their business income had grown. Accelerated cash flow led to improved campaign performance and increased business income.

- Financial risk had reduced for 16% of respondents. Eliminating payment delays lowered financial risks for affiliates, providing more confidence in their operations.

- For 12%, business investment had increased. Ready cash flow enabled affiliates to invest more in their businesses, allowing them to scale operations and explore new markets.

- Only 6% responded that internal business processes had changed.

In feedback about the service, one user said: “I used Instant Payout to receive my earnings from a freelance project faster than usual. This feature helped because I needed the money urgently to pay some bills and expenses. With Instant Payout, I didn't have to wait for the regular payment cycle and could access my funds immediately.”

The rise of the PayTechs disrupting traditional payment systems

As the digital economy grows and advertisers’ appetite for fast payments increases, the market is likely to see many more integrated solutions for both advertisers and publishers emerge to meet this new demand.

According to Ernst & Young, a new league of players exists: the PayTechs. These now make up 25% of the tech market worldwide and are focused on the payments value chain, payments facilitators (PayFacs), PSPs, networks creating new payment propositions, and payments technology suppliers.

This rapid disruption of traditional payment systems promises to be impactful. As customer-centric technology expands into payments, here are some notable shifts:

- The digital economy is being driven by connected commerce. Faster, cheaper and safer payments are possible thanks to new payment methods which connect merchants, advertisers and publishers directly

- The concept of value beyond payment means platforms are evolving into "one-stop shops" by providing relevant services before and after payments

- Embedded payments are expected to scale and become more visible as non-financial service providers integrate payments into their customer journeys

- New ecosystems are developing that can securely store, manage and leverage data generated through payment transactions, representing new monetisation opportunities and unique customer offerings

Dedicated to facilitating revenue growth for all of our partners - advertisers and publishers alike – faster payment systems like Instant Payout represent a game-changer. By securing cash flow and encouraging re-investment, they boost sales and conversions for both parties – an essential tool for anyone willing to go that extra mile to stay ahead of their competitors.